If you're actively looking to buy a home, you've surely heard of the term 'home equity loan' a few times already. But what are they? And how can one help you get up the property ladder and into that dream home? Let's dive right in and start with the basics.

Home equity is the difference between the market value of your home and the amount owed to the lender who holds the mortgage. Your equity is the money you would receive after paying off the mortgage, if you were to sell the home.

Equity is also talked about in business (as seen on Dragon’s Den!). An investor might choose to buy 10% of the equity in a company. The value and payout from the 10% equity share is dependent on the company’s success and valuation as a whole.

What are home equity loans?

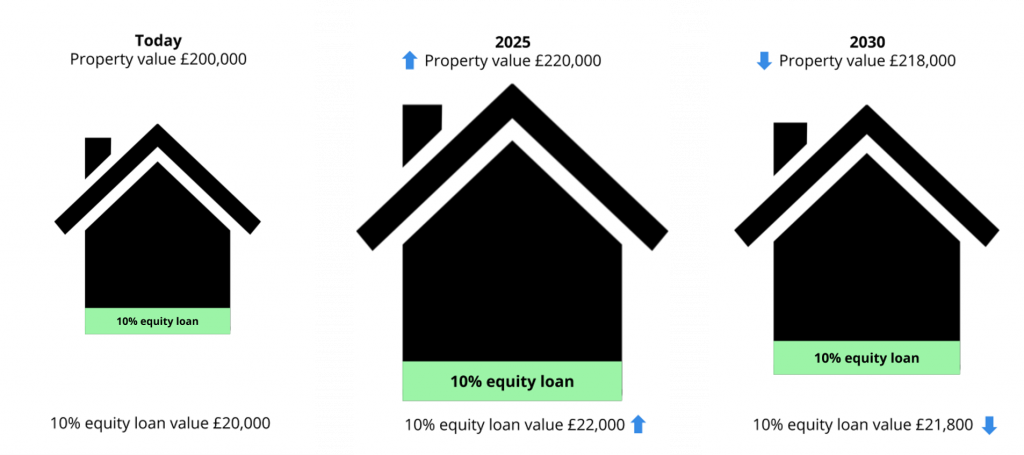

A home equity loan is a type of mortgage which can help you finance a home. The loan is tied to the value of the asset - in this case, a property. Equity loans such as the Peculiar Loan are always a percentage value, for example, 10% of the property value. For a property worth £200,000, a 10% equity loan means an initial loan amount of £20,000. If the property changes in value, the percentage stays constant at 10%. But we calculate the sum of cash to be repaid by looking at the changing value of the property.

Let's have a look at the diagram below.

As the house price goes up, so the equity loan value goes up. As the house price goes down, so does the value of the equity loan.

In most cases, and particularly for First Time Buyers, an equity loan is taken out alongside a main mortgage.

It's fairly simple: equity loan + mortgage + deposit = home value

So why would I take an equity loan?

The advantage of an equity loan is that if you combine it with a standard mortgage loan, you may be able to increase your buying power and afford a better home.

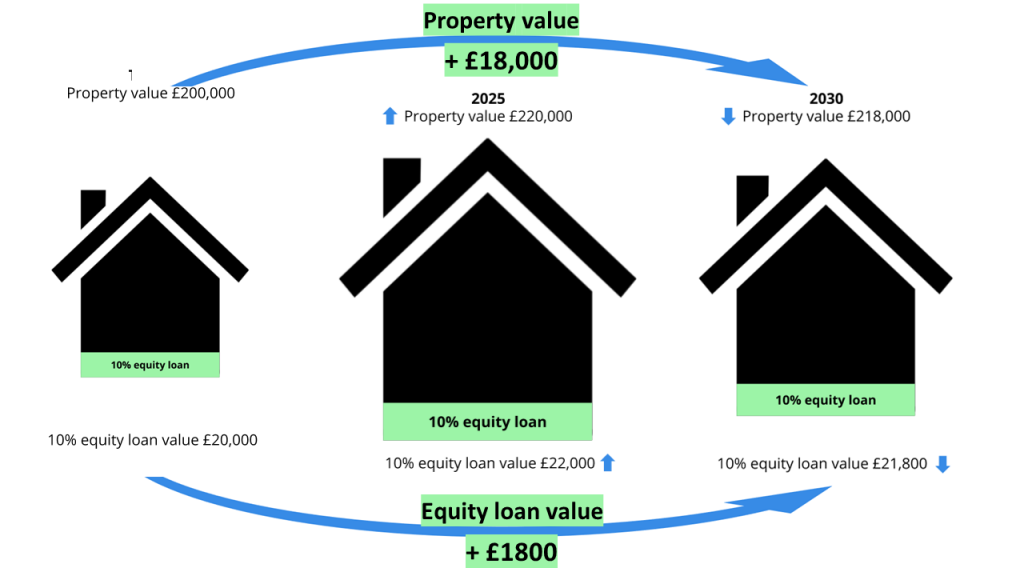

If you look at the bigger picture, you might be able to increase your yield by taking an equity loan. In our example, the overall property value has increased by £18,000, and the equity loan value has increased by £1800.

The difference of £16,200 goes straight to the homeowner, as their equity has increased.

Peculiar Tip

On the other hand, a standard mortgage loan is for a fixed amount of cash (e.g. £180,000). It is not tied to the property value and will not change over time.