If you’re saving up for a deposit to buy a home, you might have already considered the additional expenses it involves, such as stamp duty tax. In July the government announced a Stamp Duty holiday that ends March 31, 2021. We know most of us would love to take a holiday ourselves, but this is a different kind of holiday. However, time is almost running out to get onto this holiday - if you’re looking to buy your home and take advantage of these savings, you’ll need to have an offer accepted before the end of the year! There’s a lot that the Stamp Duty holiday can do for you, so read on to find out what it’s all about.

What is Stamp Duty Tax?

At this point, you’ve probably already considered this pesky extra cost of buying a home: this government tax paid on residential property purchases across England is required on properties valued over £150k. If you, like many of the rest of us, are looking to get onto the property ladder or want to find a bigger home to fit your growing family, these additional costs can be incredibly daunting.

Stamp Duty Holiday - what has changed?

Fortunately, at a time when we were all on the hunt for good news, the government announced a Stamp Duty Holiday that could save the average homebuyer in London over £10,000 on their home purchase. You’ll no longer need to pay this intimidating tax on the purchase of your home valued £500,000 or lower!

So what exactly does that mean for you? Well in short, it means you could be saving a lot of money that you can put towards your next real holiday. Consider a purchase of a home as your main residence of £400,000: before the Stamp Duty Holiday, you would have paid £10,000. However, until the end of March, you would pay £0 in Stamp Duty. That’s an extra £10,000 that you can put towards decorating your new home with some leftover spending money for Christmas shopping!

This calculator gives you an idea of how much money you could save on your home purchase with the Stamp Duty Holiday.

But time is running out! The Stamp Duty Holiday is in place until 31 March 2021, so you’ll need to move rather quickly if you want to complete your home purchase by then.

Helping Ashley & Dev

Take for example, Ashley and Dev, who came to Peculiar in the beginning of October. They knew that renting their 1 bedroom flat in central London, with no outdoor space wouldn’t cut it anymore, and this became abundantly clear for them as the second lockdown began at the beginning of November. Both of them had been working from home, and now with a baby on the way, it was obvious they needed an upgrade. They began their search immediately, and viewed eight properties over the course of two months. By mid-November, they found a 2-bedroom home with a garden listed at £550,000 that they knew would be perfect to begin their new family. From there, the steps were simple:

- We got them introduced to a mortgage advisor who helped walk them through the finer details of their circumstances.

- They put down an offer for £500,000 (following Peculiar’s machine-learning backed home finder tool). The seller counter-offered for £525,000 and they ultimately settled on £520,000. The negotiations with the seller took about 2 weeks.

- Once they had the offer accepted, their mortgage advisor began their application for their main mortgage and the Peculiar Loan the last week of November.

With the application in place, Ashley and Dev are incredibly relieved to know that they’ll soon have a place to call their own! Even better, they are expected to complete their home purchase (complete with getting the keys) by the end of February, well in time to take advantage of their savings of £15,000 with the Stamp Duty Holiday.

How to buy a home before 31 March 2021

Now, of course we all want to be in Ashley and Dev’s shoes (and sooner, rather than later), but we also know how busy this time of the year gets, especially when work collides with shopping for those elusive Christmas presents (PS5 anyone?). Even though March is just around the corner, the market is still ripe for the picking, and we are rooting for you to create your own version of Ashley and Dev’s story.

Here are a few tips from Peculiar to help you get to that finish line.

Ensure all of your ducks are in a row

Speak with your mortgage advisor, have a clear understanding of what will be needed in the process to come. Having all of your documentation ready will also minimise any delays: pay slips, bank statements, proof of identity, etc.

Look for short chains

When searching for a property, look for those that have no chain or as short of a chain as possible. Getting stuck in a long property chain will undoubtedly slow the process down.

Consider speaking to a mortgage advisor as soon as possible

They’ll help you better understand your affordability. Getting an agreement in principle (AIP) will also boost your credibility with sellers and estate agents.

Be proactive

Staying in touch with your mortgage advisor and your solicitor will help make for a smooth-sailing property journey

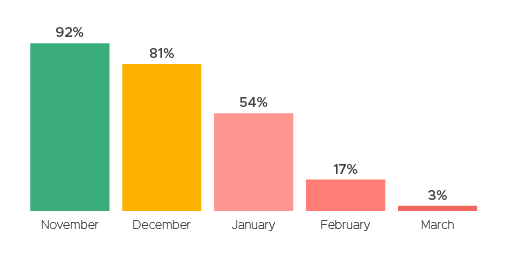

Likelihood to complete by 31 March 2021 depending on application date: