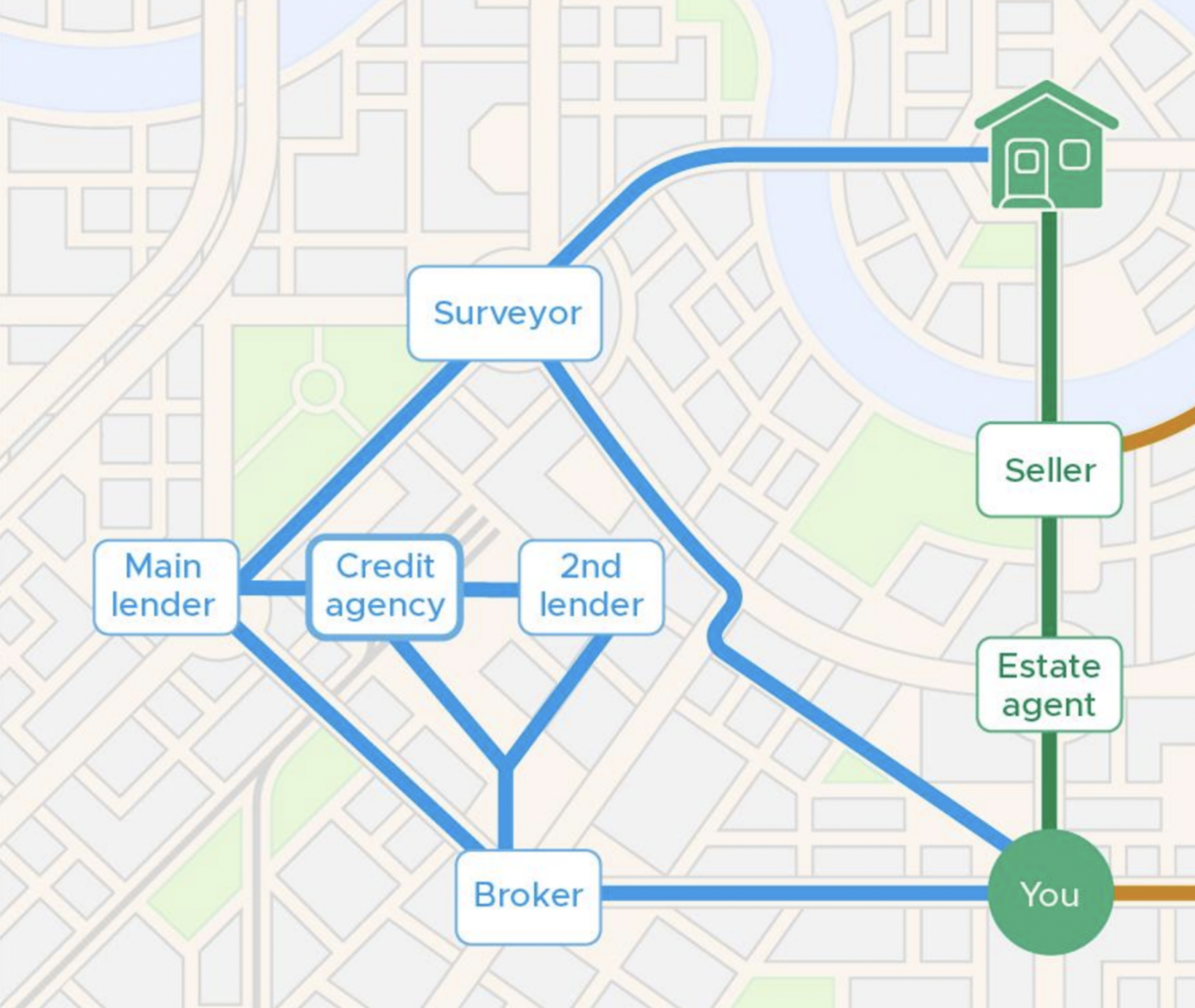

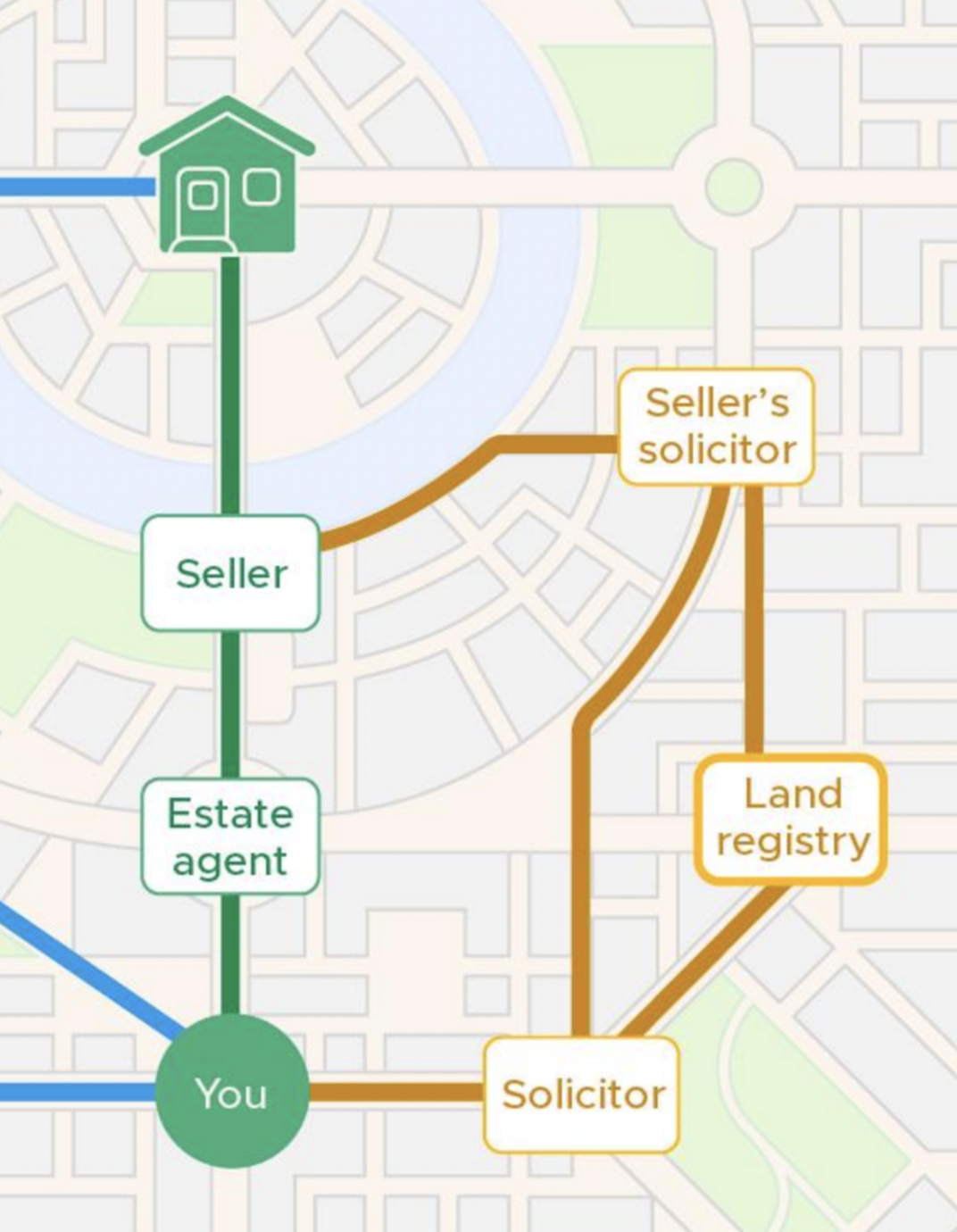

Buying a home is a complex process – you’ll be dealing with several different people to cover both the financial (borrowing) and legal (administrative) side of purchasing a property.

Follow our guide below to understand how they all work together, and with you, to fund and administrate your home purchase. Our handy A-Z glossary can help clarify any jargon.

The property team

Seller

Aalso known as the vendor. They are selling the property you want to buy, and will have enlisted the help of an estate agent to do so. They have the final say on the offer accepted for the property. They may have some requirements on the timescale for completing the purchase and moving out.

Estate agent

Think of them as the seller’s agent. They manage the marketing and viewings of the property, communicate property offers to the seller, and will hand over the keys on the date that the purchase is completed.

Buyer

That's you! No home buying process can do without one. You’ll be purchasing your new home, helped by funds from a lender.

The finance team

Broker

A qualified mortgage broker, or financial adviser, who will give regulated advice on a mortgage product. Their job is to explain the financial impact of taking on a mortgage loan. They will ensure that the mortgage product you choose is affordable for your circumstances. If you approach a lender directly, eg if you go to your bank, they will usually provide, or recommend, the services of a broker. Using a broker is the only way to apply for a mortgage loan in the UK.

Main lender

The mortgage provider for the largest share of the home purchase price. Also known as a first charge mortgage, usually this lender will be a bank or building society. Each lender has restrictions (lending criteria) on who they will loan to. For example, they might specify a minimum income or residency status. A broker will inform you of this criteria, as well as how much you could borrow and how much it would cost you.

2nd (additional) lender

An optional secondary loan to help buyers increase their affordability. This can help them buy a property that fits their needs. This is more typical in expensive areas (such as London) and for first time buyers. Help to Buy and Peculiar are examples of additional lenders offering home equity loans, which are essentially second charge mortgages. They may have slightly differing lending criteria to the first charge mortgage. You would need to consult your broker, and receive advice on whether an additional loan would be a sensible choice for your circumstances.

Peculiar Tip

The main lender is also known as the "first charge lender". And the additional lender as the "second charge lender". This simply refers to the financial stake they would have in your property, if anything were to go wrong in the repayments of the loans

Surveyor

This qualified professional visits the property in person to assess its value compared to the agreed purchase price. A survey is required by the mortgage provider to check that the property is as advertised. Some lenders will arrange this for you and cover the cost of a basic survey. You as the buyer may choose to pay an additional fee to have further extensive checks as part of the home buying process, or even arrange your own independent broker survey.

Credit agency

Gives information to the lender regarding the buyers’ credit history. When considering a mortgage application, a lender will investigate the buyers credit history, to see if they have reliably paid back previous loans. The lender will carry out a hard credit check, but only once the application has been submitted. A broker can carry out a soft credit check prior to the submitting a loan application. See credit ratings

The legal team

Solicitor

Draws up the contract for the property purchase. any contract relating to the purchase or sale of land must normally be written by a qualified legal professional, which could be a solicitor, or more often a conveyancer. This ensures the contract is legally binding and conforms to English or Welsh law. The conveyancer (or solicitor) will also request and check other legal contracts and records relating to the property, such as the water supply and planned construction works. This upholds the buyers’ right to making an informed purchase regarding the current and future condition of the property. The legal professional will also record the sale of the property with the land registry.

Land Registry

Holds the record of land ownership over the whole of England and Wales. It is a governmental department that manages information on a property’s owner, a property’s defined boundaries, and the mortgage status.

Seller’s solicitor

The seller’s legal representative will draft the contract for the sale of the property, to send to your solicitor. Both solicitors will communicate about the contract’s amendments and agreed dates for exchange and completion of the property purchase.